For each of the following annuities calculate the present value – For each of the following annuities, calculate the present value. This comprehensive guide will provide you with the knowledge and tools to accurately determine the present value of annuities, empowering you to make informed financial decisions.

Understanding the concept of present value is crucial for evaluating the worth of future cash flows. This guide will delve into the formula, types, and applications of present value calculations, providing you with a solid foundation in this essential financial concept.

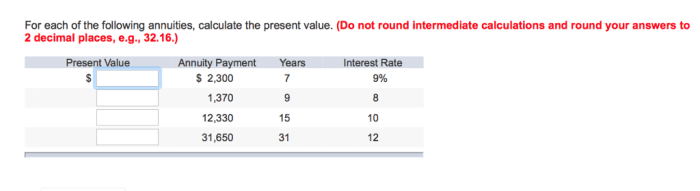

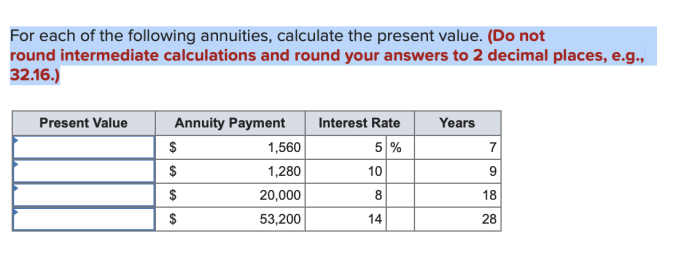

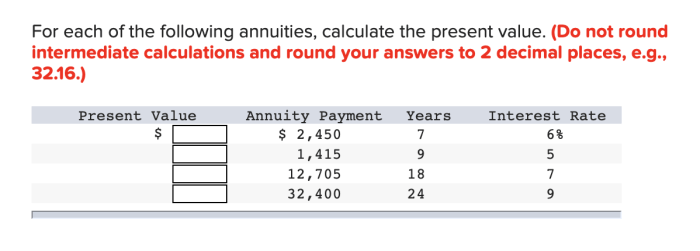

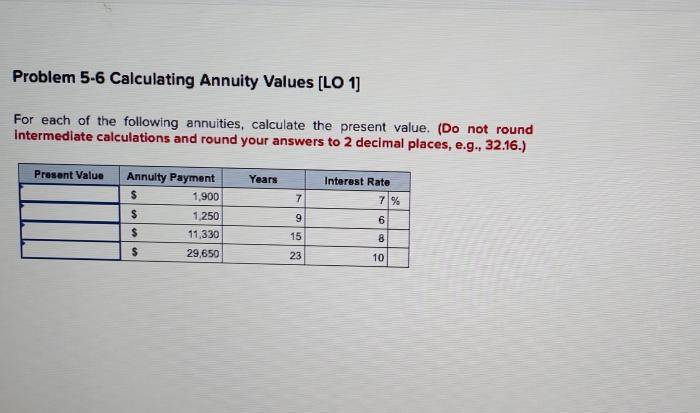

Present Value Calculation

The present value of an annuity is the current worth of a series of equal payments received at regular intervals over a specified period.

The formula for calculating the present value (PV) of an annuity is:

PV = PMT

- [1

- (1 + r)^-n] / r

where:

- PMT is the amount of each payment

- r is the annual interest rate

- n is the number of payments

For example, if you receive $1,000 per year for 10 years at an interest rate of 5%, the present value of the annuity is:

PV = $1,000

- [1

- (1 + 0.05)^-10] / 0.05 = $7,721.70

Types of Annuities

There are three main types of annuities:

- Ordinary annuity: Payments are made at the end of each period.

- Annuity due: Payments are made at the beginning of each period.

- Perpetuity: Payments continue indefinitely.

Ordinary annuities are the most common type. Annuity due payments are equivalent to an ordinary annuity with one additional payment at the beginning.

Time Value of Money

The time value of money (TVM) is the concept that money today is worth more than money in the future due to its earning potential.

The TVM affects the present value of annuities because it discounts future payments back to their present value using an interest rate.

The higher the interest rate, the lower the present value of an annuity.

Applications of Present Value Calculations

Present value calculations are used in a variety of financial planning applications, including:

- Evaluating investment opportunities

- Determining the present value of future income streams

- Calculating the amount of money needed to save for retirement

Present value analysis is an essential tool for making informed financial decisions.

User Queries: For Each Of The Following Annuities Calculate The Present Value

What is the formula for calculating the present value of an annuity?

The formula for calculating the present value of an annuity is: PV = PMT – [(1 – (1 + r)^-n) / r]

What are the different types of annuities?

The different types of annuities include ordinary annuities, annuities due, and perpetuities.

How does the time value of money impact the present value of annuities?

The time value of money states that money today is worth more than money in the future. This means that the present value of an annuity will decrease as the time period increases.